The price of houses with more than three bedrooms continues to rise

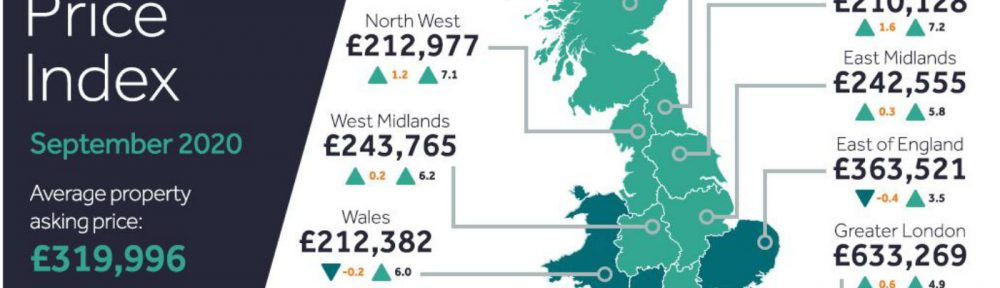

According to the Rightmove House Price Index, the cost of three- or four-bedroom homes suitable for second steppers hit a record £291,618 in September.

The cost of these homes increased by 0.4% month-over-month and 5.7% annually.

However, first-time homebuyers’ price has fallen 0.4% monthly to £200,324, although they are still up 4.2% year-on-year.

“There is still uncertainty in the market.”

Jeremy Leaf, North London Realtor, and former RICS Residential Chairman said: “The latest figures from Rightmove demonstrate the considerable strength of the pickup in buyer demand immediately before the latest restrictions on businesses and homes were applied.”

“However, confidence in the longer-term housing market outlook appears not to have diminished, as well as the many reasons behind it, such as the stamp duty holiday and low-interests, regardless of the uncertainty caused by worsening job prospects and the real possibility of a no-deal Brexit.”

Tomer Aboody, director of real estate lender MT Finance, said: “This current boom is a good sign as buyers are looking for more space and understand that this is a premium. The stamp duty stimulus, along with cheaper mortgages than never, does it mean that more people are more confident to take the plunge and buy a home.”

“Cheap money, high-credit mortgages, well-capitalized banks willing to lend and high demand from buyers are the main reasons for the rebound in sales. There is also a desire to act quickly in the face of a possible widespread deterioration in credit ratings of people due to looming uncertainty about job security caused by the pandemic.”

“The market will need more help, and hopefully, the government’s encouragement to offer higher LTVs will have a real positive impact, along with any possible additional extensions to the stamp duty franchise.”

If prices go up, does that mean there won’t be a crash?

Although houses prices have continued to rise considerably, most experts who have studied the property market this year have agreed that a crash is expected at some point in 2021.

The main reason for this crash would be that due to the COVID-19 pandemic, the market experienced too many changes in a very short time. Even though the UK government took action on the matter, they only served as a temporary measure.

Our advice is to act with caution and study the market carefully before buying or selling a property. Otherwise, you would be risking losing a large amount of money if the expected crash occurs.

At HICH LTD, we will continue to monitor the market to offer you the most relevant news on this crucial topic!

HICH LTD offers the best property survey service before, during, and after the pandemic. We have redoubled our efforts to maintain the quality standard that has made us a leading property survey company.

Want a Building Survey? Request it here!

Follow us on our social networks to keep up to date with the most relevant property market news, tips for being a responsible homeowner, and much more!

Twitter: @HichLTD

Facebook: HICH-LTD