Home >

News > Tips to secure your Help to Buy equity loan

Tips to secure your Help to Buy equity loan

With the Help to Buy equity loan deadline on the 31st of October fast approaching, Claire Flynn, mortgage expert from money.co.uk, has provided her top tips on how to secure a Help to Buy equity loan before applications close.

What is a help to buy equity loan?

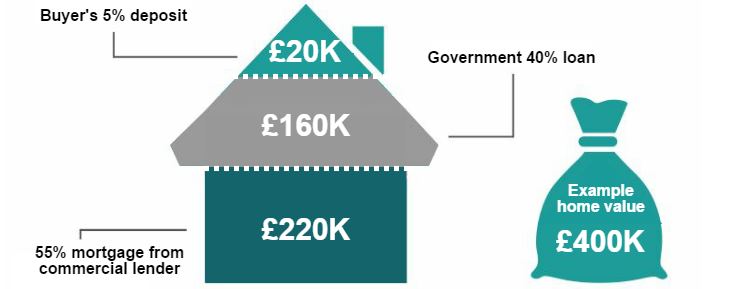

“A Help to Buy equity loan is a government-led scheme to help first-time buyers buy a new-build home. The main aim of this scheme is to help first-time buyers get onto the property market. If you’re eligible for this scheme, you can borrow up to 40% of the market value of new-build property in London or 20% of the market value outside of London. The maximum property price available to purchase also varies between regions. The equity loan is used alongside a deposit and mortgage (of at least 25% of the property purchase price) to cover the cost of buying a new-build property.

How can I take advantage of the scheme?

“If you’re planning to purchase a new build before the 31st of March 2023 and plan to use a Help to Buy equity loan towards the cost, you must apply before applications close on October 31st 2022, in England. To take advantage of the scheme, you must reserve your home and meet with the homebuilder before 6 pm on October 31st 2022.

The home must have reached practical completion and have received a new-home warranty by December 31st 2022. You must also have received the keys to your new home by 6 pm on March 31st 2023, to stay eligible for the equity loan.

How do I apply for a Help to Buy equity loan?

“The Help to Buy equity loan application process is fairly straightforward. Firstly, you’ll need to reserve a new build property with a builder registered with the scheme. You can then apply online through a Help to Buy agent in your region. You will be asked to fill in a Property Information Form so you can give your financial information and personal details. Once given Authority to Proceed, you can apply for a mortgage and progress your application to the exchange of contracts.

How do I pay back the loan?

“The equity loan must be paid back in full at the end of the loan term or when you pay off your mortgage or sell your home. You can repay part or all of your equity loan at any time, but you’ll need to get a market valuation report from a chartered surveyor when you repay. Repayments are based on your equity loan percentage and the market value of your home at the time of repayment. Be mindful that you will begin paying interest in the sixth year of your loan. This means that part payments often reduce the amount you owe; however, any part payment you decide to make must be at least 10% of the market value of your property at that point in time.

What can I do if I miss the deadline?

“If you’re planning on buying a house after Help to Buy applications close, there are other government-led schemes available to help you do so, such as the Shared Ownership scheme. The Shared Ownership scheme is useful to anyone who can’t afford a deposit and mortgage repayments on the house. Rather than buying a full property, you buy a share of the house and pay the rest to the landlord through rent. You’ll need to buy between 10% and 75% of the market value price of the property, as well as be able to put down a 5% to 10% deposit on the property.

HICH LTD has continually raised the quality standards in the UK property survey market. Our multi-award-winning property survey service has made us the leading reference in the property survey market.

We offer property survey services of the highest quality. Using state-of-the-art equipment, we provide top-notch property surveys at affordable prices. Our prices are based on the number of rooms rather than the value of the properties, so you will always get the best value for money with our services.

Please look at our Trustpilot page and see why customers have chosen us as their favourite property survey provider!

At HICH LTD, we work to serve our clients and make the world a better place for everyone. We actively collaborate with NGOs to promote environmental, social and charitable causes. If you want to know more about our efforts or how you can help, contact us at hichinfo@aol.co.uk.

HICH LTD extends a warm invitation to contractors and service providers throughout the UK to join our network; by joining the Contractors and Service Providers Network, you will enjoy benefits such as a significant increase in customer flow, advertising on our high-traffic website, and direct contact with thousands of customers in your zip area. Find more information here or by following the QR code in the following video.

Are you looking for a roof, structural, or bespoke survey? Request it here!

Follow us on our social networks to keep updated with the most relevant property market news, tips for being a responsible homeowner, and more!

Twitter: @HICHLTD

Facebook: HICH-LTD